Treasury is a diverse and exciting area of finance to work in. It’s a career that will see you make a real difference to the success for any organisation. Your role and responsibilities will vary depending on the size and nature of the business you are working in.

In this role, you are essentially a trusted advisor to the business on financial matters, help develop long-term strategies and policies, and always ensure the company has enough money.

Treasury looks to the future of things to come, rather than focussing on things that have already happened. Your goal is to manage the businesses money and financial risks.

It involves a lot of planning and the decisions you make will have a direct impact on performance and profits.

It’s imperative to make sure the business has the capital it needs to manage day-to-day obligations. Treasury focuses on how and where is best to put money. You’ll also consider any risks associated with this. Every business takes risks. It’s the treasury professional’s role to identify, assess and manage these risks so they support the business’s objectives.

You’ll also help to identify and create new opportunities that could benefit the business.

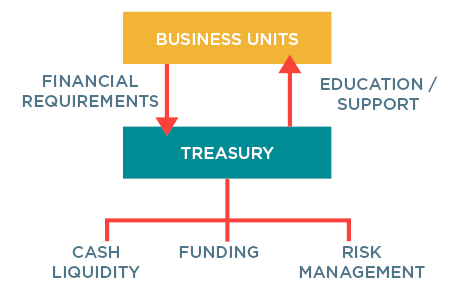

KEY ROLES OF TREASURY

Look at these two real examples:

1. A business wants to expand its operations into a new region, which will generate significant revenue and create a competitive advantage. Your role is to assess the risk, weigh up the pros and cons and determine if this is a good move for the business. If it is, you’ll develop and implement a financial strategy that supports the business expansion.

2. Economic factors such as interest rate rises, changes in regulations and volatile foreign exchange rates can have a serious impact on any business. Your role is to monitor and assess these market conditions, determine how these external factors could or will impact the business; and put strategies in place to mitigate any potential financial risks to the business.

In larger organisations, you will find whole treasury departments as finances are exponentially more complex. However, so many professionals, finance or otherwise, perform treasury functions without even realising they are doing treasury!

For example, if you are setting up your own business selling homemade cakes and don’t employ a team of staff, you’ll be performing treasury functions yourself. Ranging from choosing how to initially fund the business (which bank/lender, tenor, amount, repayment profile, fixed/variable rate), to what to invest your profits in to ensure you can expand your business and managing net working capital (trying to ensure you receive money for the cakes, before having to pay for the cake mix).