Practical risk management needs a structured approach. This includes classifying and analysing risks. FX risk is one of the most complex risks that treasurers must understand and manage. Changes in FX rates can have substantial, sometimes unexpected, effects on every type of organisation – even the simplest domestic one. As a treasurer, you need a deep, applied and integrated understanding of FX risks. This article applies and integrates three powerful FX risk frameworks in a practical case study.

CASE STUDY - FX RISKS

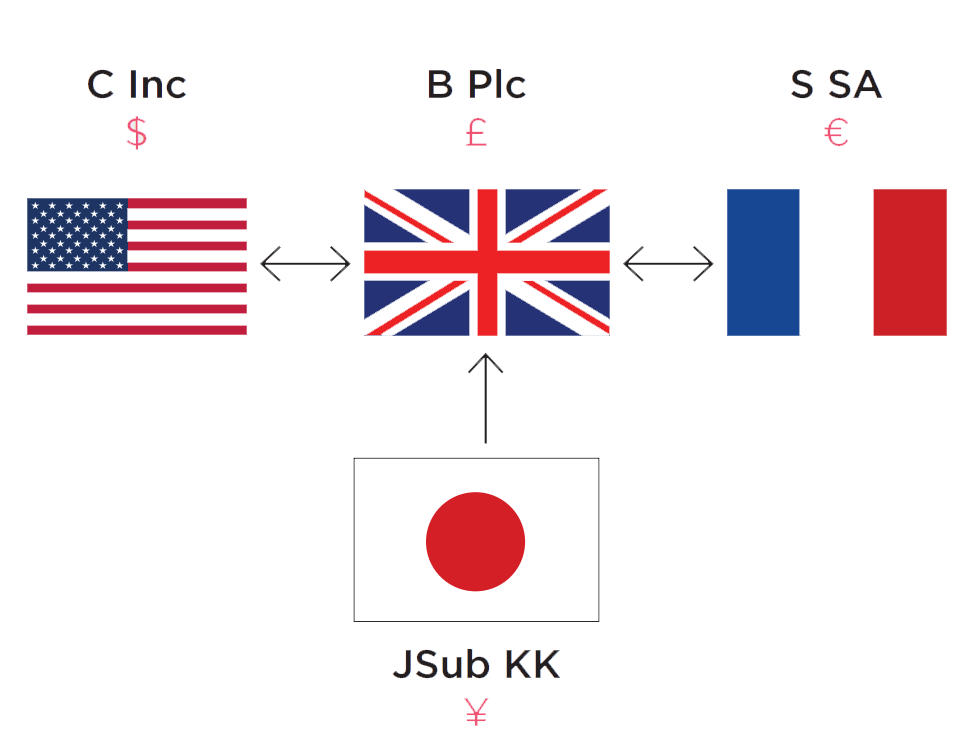

B Plc operates in an intensely competitive market, reporting its results in sterling. B Plc sells in both US dollars and sterling. It imports substantial quantities of raw materials from Supplier SA (S SA), priced in euros. These customers and supplier are all a long-term part of B Plc’s supply chain. B Plc has submitted a large tender to Customer Inc (C Inc), in US dollars. B Plc also owns JSub KK in Japan, which operates and reports in Japanese yen.

WHAT ARE B PLC'S FX RISKS?

We'll start by applying the first FX risk framework below.

| FX RISK TYPES |

| Transaction Pre-transaction Economic Translation |

| TRANSACTION RISK |

| The risk of changes in domestic currency value paid or received, under committed foreign currency-denominated transactions, to be settled in the future. |

B Plc buys materials priced in euros from S SA in France, placing orders three months ahead. If the euro strengthens, it costs B Plc more to settle its eurodenominated liabilities when they are due for payment. This is an FX transaction risk.

| PRE-TRANSACTION RISK |

| Exposures resulting from commitments to a price list or tenders in a foreign currency, or price lists or tenders with a foreign currency cost component. |

B Plc has submitted a large tender to C Inc, priced in US dollars. If the dollar weakens, the sterling-equivalent value of the contract price will fall. The contract will be less profi table for B Plc, perhaps even loss-making. C Inc can oblige B Plc to undertake and complete the contract, however onerous it becomes for B Plc. B Plc has a pre-transaction exposure to the dollar. Another pre-transaction risk for B Plc is the euro cost component of fulfilling the contract.

| ECONOMIC RISK |

| The risk of changes in the value of an undertaking, due to cost base or competitive position changes, driven by long-run FX rate changes. |

B Plc has an economic exposure to the euro. If the euro strengthens, future raw material costs from France could increase. B Plc also has an economic exposure to the US dollar. If the dollar weakens, B Plc’s sterling-equivalent sales revenues will fall. Perhaps surprisingly, S SA also has an economic exposure to the euro, even if its own costs and revenues are matched in euros. S SA might wrongly assume that it had no FX risks. The risk for S SA is that if the euro strengthens, S SA’s competitiveness will deteriorate. For example, its sterling-based client, B Plc, may choose to go elsewhere. Uncovering this type of potential risk blind spot is one of the most important benefits of using a risk framework.

| TRANSLATION RISK |

| The risk of changes in reported accounting values, resulting from the translation of items denominated in foreign currencies. |

B Plc’s subsidiary, JSub KK, gives rise to FX translation risk, among other risks. The translation risk arises because JSub KK reports in JPY. If the JPY weakens against sterling, the sterling-equivalent value of JSub KK’s net assets falls. This, in turn, reduces B Plc group’s shareholders’ funds (reported accounting net worth) in sterling. Moreover, the sterling-equivalent value of JSub KK’s profi ts willalso fall, reducing B group’s reported consolidated profits in sterling. This, in turn, can affect important credit ratios, including cash-fl ow ratios, balance-sheet gearing ratios and interest cover. Following adverse changes, borrowing may become more expensive, with possible deterioration in credit ratings. In extremis, there could even be a breach of covenant and default under existing borrowings, potentially leading

to insolvency.

Can we hedge FX translation risk?

Yes, we can. However, our risk-hedging responses can themselves introduce other risks and costs. In some contexts, it may be more appropriate to monitor and communicate the risk, as discussed below.

INTERLOCKING FRAMEWORKS

A second powerful overarching risk framework considers (1) risks of trading, and (2) risks of ownership. This perspective allows us to see more deeply into the four types of FX risk we’ve already identified, and identify how they are inter-related.

Risks of trading

Many financial risks follow on directly from operations and business risk. The financial risks of trading arise from buying and selling the things that make up cost of sales and turnover, leading to reward from business risk. These are the risks of trading. FX risks arising in trading come about when there are mismatches between the currencies of our revenues and costs, or between the currencies of our cost base and that of our competitors. FX risks of trading include transaction risk, pretransaction risk and economic risk.

Risks of ownership

FX translation risk is primarily a risk of ownership. In the case of earnings, it can be argued that this is a simple risk of doing business overseas so that lucrative markets can be tapped, and the immediate cash effect is minimal.

Accordingly, one response is to take no hedging action, monitor the evolving position and report current profits against prior profits: the movement in exchange rates factored out and reported separately, in ‘constant currency terms’. If we do this, we must communicate clearly and consistently with all our stakeholders, to make sure they understand the resulting volatility.

COMMITMENT

A third interlocking risk framework considers committed and uncommitted risks. Committed risks are ones to which the business is irrevocably committed. Uncommitted risks are potential transactions that can be anticipated as part of continuing operations. These risks can also be viewed as strategic or economic. B Plc imports substantial quantities of raw materials from S SA in euros, placing orders three months in advance. B Plc’s economic exposure to the euro is always present and needs continuous management.

The orders three months ahead can be hedged, for example, with forward FX contracts. The remainder of the planning period is an uncommitted or strategic exposure. As time passes and orders are placed, the uncommitted risk converts into a committed risk.

HOW FAR AHEAD SHOULD I PLAN FOR FX?

The optimum hedging time horizon varies between markets and organisations. B Plc operates in an intensely competitive environment, so its flexibility is likely to be very limited in the short term. Accordingly, B Plc needs to take a longterm view on risk management and manage strategic exposures as well as operational ones. This is particularly important if B Plc has a long product manufacture, delivery, sales and payment cycle. As treasurer, you should also investigate and contribute to the whole process(es), including FX rate assumptions, used both to set the prices given to B Plc’s customers, for example, the tender price to C Inc, and the prices agreed for raw material purchases from its suppliers. The time period over which risks are open should ideally be cut as far as possible.

____________________

Author: Doug Williamson

Contributors: Will Spinney and Paul Cowdell

Source: The Treasurer magazine