Many corporates are concerned about pension costs and risk. Jos Vermeulen considers some options for derisking defined benefit schemes

Many companies are concerned about the costs and risk of their defined benefit (DB) pension scheme on the balance sheet. Therefore, a big focus for them is on how to secure all the liabilities as quickly as possible without taking undue risk and at the lowest possible cost.

Potential ‘endgame’ options include an insurance buy-out (all the scheme assets and liabilities are transferred to an insurance company) or a run-off (the scheme pays off liabilities as they fall due with little or low sponsor dependency).

However, most schemes cannot afford these options today without substantial cash injections, so have to consider different derisking paths to get help them there.

An increasingly common option is an insurance buy-in, whereby a scheme transfers some assets to an insurance company, in return for a stream of cash flows. These typically reflect the payments to be made to pensioners.

Should schemes and corporates consider insurance buy-ins or should they evolve their current, often sophisticated, derisking strategies, taking a ‘self-managed’ approach? The latter can potentially replicate the key characteristics of an insurance approach – such as hedging longevity risks and generating cash flows to match outgoing payments – more cost-effectively and efficiently across the entire pension scheme.

To help make an objective comparison of different derisking options, we believe an objective three-point framework is useful. This examines:

- value for money;

- impact on the overall portfolio; and

- flexibility to deal with the unpredictable

1. Value for money

A major driver of the increasing demand for buy-ins is the seemingly competitive pricing from insurers. Typically, buy-in contracts are priced on a ‘gilts plus’ basis, making them look attractive when compared to the cost of matching pension liabilities with government bonds. However, investors should not focus on price alone, but focus on what they receive for this price.

A self-managed approach is able to replicate many of the characteristics of an insurance buy-in, including longevity hedging, but at a lower cost due to the allowance in insurers’ pricing for capital and profit margin considerations, and more stringent investment restrictions.

We estimate that companies can manage their pension scheme liabilities over time with savings of up to 10%, relative to the cost of using a buy-in, when considering the whole scheme membership. In the case of a typical pensioner-only transaction, this equates to a saving of £100m assuming a buy-in of £1bn.

2. Impact on the overall portfolio

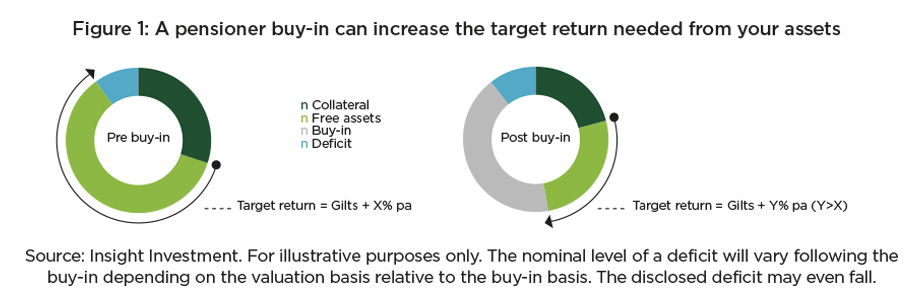

An insurance buy-in offers security and cash-flow matching in respect of a portion of the liabilities, but schemes should consider the broader impact on the overall portfolio. In particular, how does a buy-in impact the expected return needed on the remaining assets and the overall risk of the pension?

If a scheme is underfunded, the nominal level of deficit will vary following the buy-in depending on the valuation basis relative to the buy-in basis. The disclosed deficit may even fall. Crucially, however, a buy-in leaves fewer ‘free’ assets to make up any funding-level deficit. This increases the target return needed from the remaining assets, everything else being equal.

The pursuit of higher target returns following a buy-in increases the chance of negative returns, especially during times of market stress. Ultimately, it potentially reduces the chance of the scheme being able to afford a buy-out at the target date.

3. The flexibility to deal with the unpredictable

Up to the point of a full buy-out, regardless of the adopted derisking method, there will always be risks affecting the assets or the liabilities that cannot be predicted or hedged. Examples could be poor short-term returns, changes to members’ longevity, transfer values forcing payments earlier than expected, or changes in legislation causing changes to benefits. Buy-ins can significantly reduce the flexibility of a pension scheme to adjust its strategy following unexpected changes.

Conclusion

We suggest that stakeholders look beyond buy-in prices alone and assess the impact at the total scheme level, considering a wider range of factors, such as value for money, the impact on risk and return requirements on the total portfolio, and flexibility to deal with unpredictable events.

We believe this will help company pension schemes to reach their endgame with more certainty – and ultimately help to reduce any unnecessary cost and volatility they might contribute to a company’s balance sheet. When considering these wider criteria, we believe a self-managed approach offers a more efficient route to the endgame for many schemes than an insurance buy-in.

___________________

Author: Jos Vermeulen, head of solutions design, Insight Investment

Source: The Treasurer magazine